Millennials are an often misunderstood generation when it comes to finances and economic preferences. Some people think Millennials are poor savers who spend their money on frivolous consumer goods while indulging on craft beer and avocado toast.

At the same time, others believe that Millennials are digital entrepreneurs who are disrupting massive industries.

It’s clear that many people just don’t understand the financial habits of Millennials. Let’s get rid of any confusion once and for all with these five facts about Millennials and saving.

Fact 1: Millennials Hardly Save For Retirement

If you’ve been led to believe that the youngest generation in the workforce are bad with their money, you probably don’t think this first fact is a surprise.

Let’s take a look at the data to see just how bad Millennials are at saving for retirement. According to a report by Nerdwallet, households led by a Millennial have a median retirement savings of $12,300. The average Millennial retirement savings account has $32,500.

Meanwhile, people between the ages of 45 and 54 have an average retirement savings account of $215,800. Both of these figures are insufficient for a comfortable retirement, but Millennial retirement savings are lagging behind older generations.

It is easy to criticize entire generations for their habits, but it’s more useful to try to understand the underlying reasons for their decisions. We’ll explore three potential explanations to understand why Millennials have unconventional (and perhaps ill-advised) retirement savings habits.

They Are Making a Big Bet on the Future

It’s possible that Millennials are not saving for their retirement years because they expect a future supported by universal basic income and similar social policies. This theory meshes well with the political preferences of young people. Millennials tend to be strong supporters of economic safety nets used in social democracies like Sweden and Denmark.

If Millennials believe that a government or similar third-party will step in to support their well-being, why would they save for retirement?

They Want to Enjoy Their Financial Returns Now

In a recent LendingTree survey, a majority of Millennials responded that they prefer to save for large near-term expenses over emergency funds, housing, and retirement. This means that young people prefer to pay off debt, save for consumer goods, and prepare for vacations. 8 percent of Millennials in the study responded that they are saving for a vacation. Just 6 percent of Millennials responded that they are saving for retirement.

Millennials are also using saving their income to secure a life of autonomy and flexibility. A study revealed that 29 percent of Millennials plan to use their savings to support their move to a job or business prospect that they enjoy.

A large number of short-term expenditures could explain why Millennials don’t want to tie their funds up in an IRA.

Employer-Sponsored Retirement Plans Are Dwindling

Young people may contribute less than workers in older generations because employer-sponsored 401(k) accounts aren’t as common as they used to be. About two-thirds of Millennials do not contribute to a 401(k). However, 9 out of 10 Millennials with an employer who sponsors their 401(k) have a retirement savings account.

This situation shows that Millennials would probably put more money aside for retirement if a larger number of employers offered retirement plans.

Fact 2: Millennials Save More Than Other Generations

This fact might come as a shock after learning that Millennials do not contribute much to retirement savings accounts. A Nerdwallet study found that Millennial parents save about 10 percent of their income, beating out both Gen-X and Baby Boomer parents. Gen-X and Baby Boomer parents saved just 8 percent and 5 percent of their income, respectively.

What could be driving this Millennial saving trend?

Age-Specific Savings Trends

It is logical that generations save a lot when they have kids. As children age, so does the size of savings. Millennials are expecting or have young children, so they must save money for medical costs, child care, and education. Once children enter high school and college, the savings rates begin to drop for parents (while their spending increases). This explanation matches the data from each generation.

Fear of Market Uncertainty

The oldest Millennials first entered the workforce during the Great Recession, a time of financial turmoil when the S&P 500 lost over half of its value. Some lingering fears of this crisis could lead to Millennials to save more in preparation of another market downturn.

These saving patterns are probably due to some lessons from the Great Recession. If your kitchen catches on fire after you leave your stove on, you think twice about leaving your kitchen unattended in the future. The same lesson applies to financial markets.

Fact 3: Millennials Don’t Invest Often

Millennials may save a lot, but they are not putting their money to work in financial markets. About 25 percent of Millennials hold their savings as cash. When you compare this figure to the average cash holding of 19 percent, it becomes clear that Millennials are demonstrating some unusual investing patterns. We’ll show how cautious Millennials drive this trend in fact 4, but let’s take a moment to talk about the effects of not investing.

Losing Out on Passive Growth

Holding your assets as cash isn’t much better than storing your funds in a mattress. The opportunity cost of not investing in financial markets is high.

Since its foundation, the S&P 500 has grown by an average of 10 percent each year. The index has had its ups and downs, but in the long run, it has always matched the long-run, upward growth of the US economy.

Past performance is never a guarantee of future returns, but (barring devastating unexpected events) it is reasonable to expect the trend to continue. You lose out on these increasing returns when you don’t invest in a well-diversified stock portfolio.

Losing Value to Inflation

Holding your money as cash also exposes your funds to the risk of inflation. Inflation is an overall change in prices across the economy. When inflation increases, you can buy fewer things with your money. Let’s use an example to drive this point.

Assume you saved $1000 in a savings account with a zero percent interest rate (the same as holding as cash) in the year 2000. Between 2000 and 2010, the inflation rate averages 2.5 percent. This means that between 2000 and 2010, your savings account actually has a “growth” rate of negative 2.5 percent per year. When you withdraw your funds in 2010, you technically have less money than you originally deposited.

Fortunately, smart investing in a variety of assets can completely offset the current risks of inflation.

Fact 4: Millennials Are the Most Financially Cautious Generation

Millennials are often labeled as short-sighted risk-takers who care only for themselves. Surely such a selfish generation would be involved in risky get-rich-quick schemes (like the CDOs that crashed the economy in 2007), right? Not quite.

Millennials are ultra-cautious individuals. This simple fact is indicated by their investing preferences. A recent study revealed that 42 percent of Millennials are conservative investors. Meanwhile, 38 percent and 23 percent of Gen-Xers and Baby Boomers are in the same category, respectively.

The cautious investing strategy of Millennials goes against conventional investing wisdom. Most finance gurus will tell you that your twenties and thirties are the best ages for aggressive investing. This strategy gives investors more time to earn high returns and recover from any losses.

A large minority of Millennials who are investing are avoiding risks. 20 percent of Millennials invest primarily in bonds, money market funds, and similar low-risk assets. Interestingly, Millennials are also investing in cryptocurrencies and other alternative assets to avoid the stock market.

Fact 5: Millennials Are Saving For Luxury

There have been many conflicting reports about whether or not Millennials are saving for luxury goods. Before you read on, make a quick Google search of “Millennials Aren’t Buying”.

A glance at the results page should show you a bunch of articles about how Millennials aren’t buying diamonds, houses, sports cars, domestic beer, and more. Based on just these results, it would be easy to say Millennials aren’t saving for luxury goods.

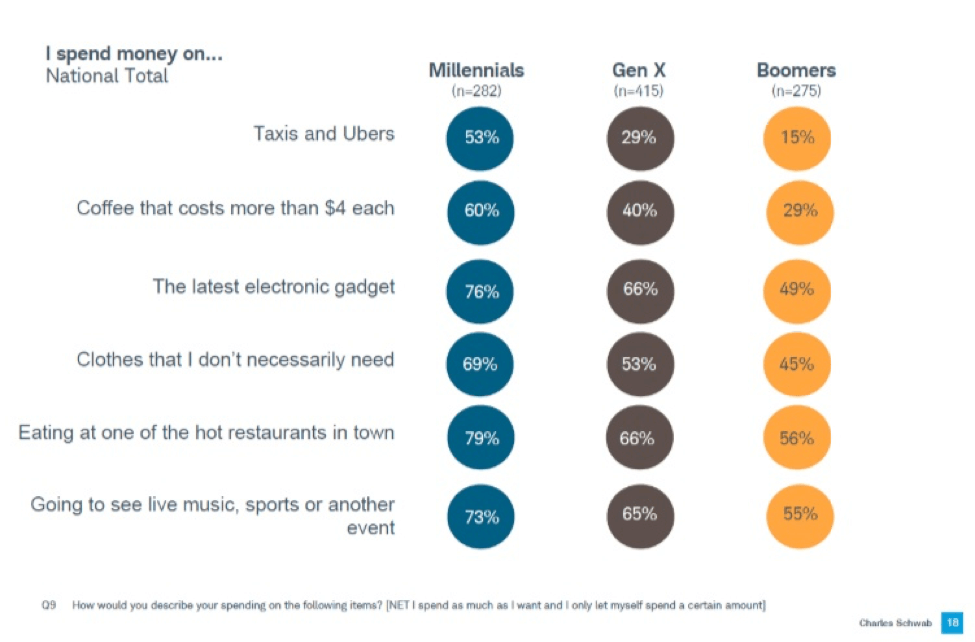

The facts disagree with this conclusion. While Millennials don’t buy a lot of the luxury goods enjoyed by Baby Boomers, they are dishing plenty of cash for dining, craft beer, apartments, and electronics. Check out the following graphic from Charles Schwab to see how Millennial spending on luxury items compares to other generations.

Millennials may not be saving much for sports cars and large homes, but survey results show that they enjoy frequent purchases in the short-term.

How To Describe the Average Millennial Saver?

Keep in mind that every individual is unique. Some Millennials are riskier than others. Some are born wealthy and don’t need to save for the future at all. However, there are a set of behaviors that make Millennials stand out from other generations.

Millennials tend to be cautious savers who try to live a good life with frequent trips and near-term purchases. They’re not saving much for retirement or to purchase a house, but this might change as interest rates slowly rise.

Millennials do appear to have short-sighted mindsets as they pursue lives well-lived. Wise Millennials should reduce a bit of their luxury spending to prep for the future. Investing in a diversified financial portfolio can help Millennials maintain their lifestyles when other expenditures become a priority when they age.