Are you a strategic investor?

I asked World Chess Champion Susan Polgar why people rarely invest strategically, and she explained to me that what happens to chess players also happens to investors.

It’s not that being a strategic thinker is so complicated; rather, people are just not in the habit. And, if you’re not in the habit of doing something, it is hard to do.

Susan, one of the world’s best chess coaches, shared three tips on how to develop strategic thinking. Turns out that that these are the same habit-building systems that successful investors use.

Try creating these three habits:

Remove Distractions

If you’ve ever watched a high-level chess tournament, you will have seen super-power minds leaning over the 64 squares of the board trying to maintain concentration. What happens, though, when their stomach growls? How do they deal with the background noises and other distractions?

Susan trains her team to maintain focus on what’s right in front of them rather than letting the outside influences invade their thoughts. To follow this championship tactic, start by turning off the financial news. It’s not that the press reports themselves are wrong; rather, the day-to-day turmoil that the media blasts may lead you to make poor investment decisions.

Studies have shown that people who make investment choices based on news commentaries perform worse than those who make their selections in a news vacuum. Next time you review your investments, don’t start by browsing the web. Instead, pull out your financial plan and compare your intended asset allocation model to your current portfolio to make sure they are in line. Creating a plan and sticking to it will serve you much better than reacting to the news.

Identify your mistakes

Not surprising, the last time I played chess with Susan I lost. I asked her what my biggest mistake was and she said, “You didn’t get rid of your bad pieces.”

The same principle applies to an investment portfolio. Investors often overlook their losing positions hoping that over time they will recover. However, I don’t understand why someone would assume that a weak would magically turn around.

Though sometimes weak companies make strong recoveries, treat that as an exception. As a general rule you should identify your weakest positions and sell them.

Don’t be afraid to admit that you may have made a mistake – everyone makes mistakes. What separates great investors from average is the ability to identify their mistakes and correct them. If you made an investing mistake, sell it now and put the money into something that has greater potential. It is better to have money sitting in cash doing nothing than to have it in a loser investment.

Don’t limit your potential

“What is the most basic lesson that you teach new chess players?” I once asked Susan. She said that when teaches beginners, she always instructs them to develop their back row pieces. Compare this with the common technique of beginners who just push their pawns into the middle and then maneuver them around. The problem with that approach is that the more powerful fighting pieces, the bishops, knights, and rooks, wallow in the back row and never reach their potential as fighters.

Investors have the same problem.

Oftentimes, people let their money sit in the bank, missing out on potential returns. Since interest rates having been incredibly low for many years, they not only missed great opportunities, but have actually diminished the buying power of that money because the cost of living (inflation) increases faster than the interest earned on bank deposits.

Certainly your emergency fund should be kept in cash. But beyond that, consider limiting your bank deposits. Put together a financial plan to determine an appropriate asset allocation (what percentage should be in equities, fixed income, real estate, cash, etc.), and then get the money to work for you.

If you want to improve your investment portfolio, develop the habits of strategic thinker. If you’re not ready to start risking your money by learning how to handle it properly and developing good financial habits, at the very least pull out your old chess set, dust it off, and start playing a few games. Hopefully, that will inspire you to become a strategic thinker… and ultimately a “Grandmaster investor.”

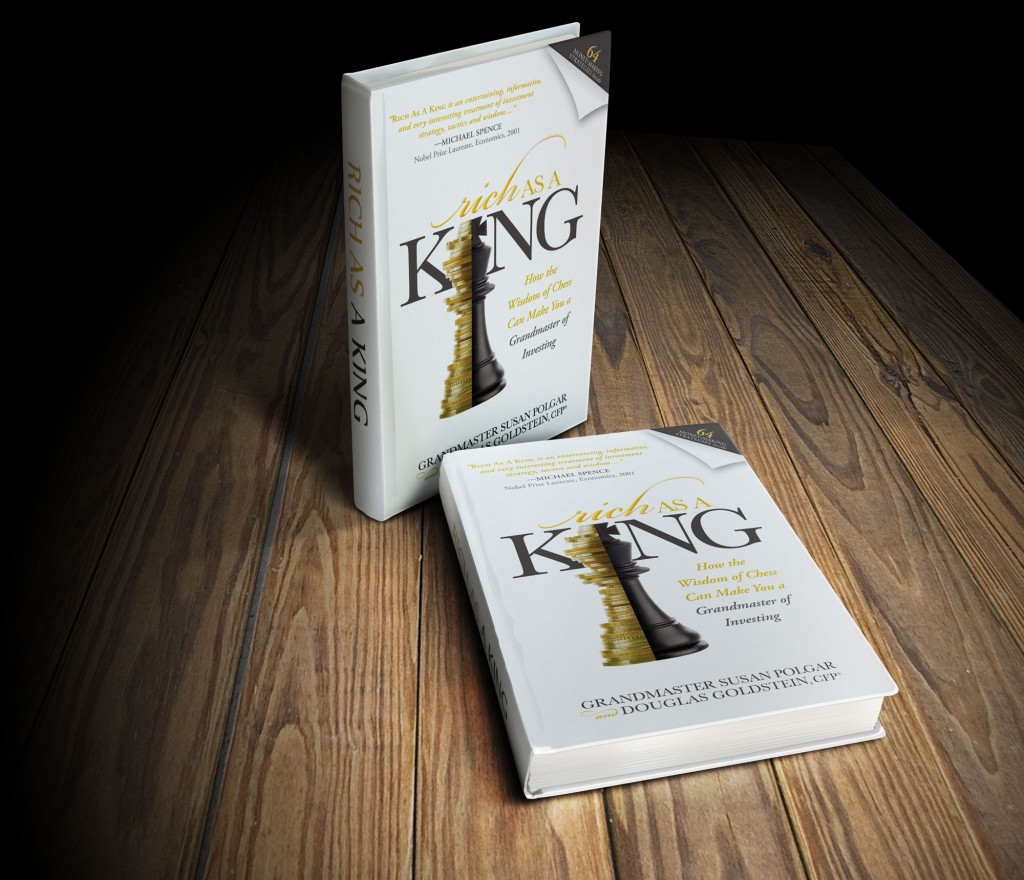

Douglas Goldstein is both a CFP® and an avid chess player. He and Grandmaster & World Chess Champion Susan Polgar are co-authors of Rich As A King: How the Wisdom of Chess Can Make You a Grandmaster of Investing. Available for sale online as well as at www.richasaking.com. Securities offered through Portfolio Resources Group, Inc., Member FINRA, SIPC, MSRB, SIFMA, FSI.