It’s no secret: Americans are not good at saving money. It doesn’t matter if we are talking about emergency funds, retirement accounts, or even just keeping a piggy bank on the dresser; the majority of Americans have grossly underfunded their accounts. The reasons why vary from they just don’t know better to they don’t make enough money. FutureAdvisor, however, wants to change the statistics to make sure everyone is able to enjoy a comfortable retirement.

90% of Americans Don’t Save Enough

Suppose you were to go out and ask people on the street this question: “What is the median retirement account balance for those approaching retirement?” What sort of answers do you think you would receive? $250,000? $500,000? I would expect that most people would think that the average retirement account is enough to cover at least a few years’ worth of expenses. The National Institute on Retirement Security, however, finds a drastically different number. Their data indicates that the average account for a person nearing retirement is just $12,000. Most people who try to retire on that amount would likely have to return to work after 3 to 6 months; let alone be able to live comfortable for 30+ years.

Life Expectancy is Increasing; Savings Rates are Decreasing

As medical technology improves, people are living longer than ever. At the same time, they are saving less and less. Despite the fact that we are living a lot longer now, when we compare our savings rates to those in the 1980’s and 1990’s, we are saving less money.

Why exactly is this? One reason may be due to the fact that people are scared of the market. If you look at the stock market, it is much more volatile in the computer age than prior. Media coverage that shows bad news can cause an instant massive drop in the market, even if there is no real bad news. This volatility sways people away from investing.

Retirement Requires More Than Just Savings

Having an emergency fund is one of the key pillars of financial success. But if you try to store up enough money for retirement in a savings account, you will fall drastically short. The simple fact is these accounts don’t earn enough interest. Smart investing, on the other hand, will bring you much closer to your goals.

For instance, suppose you are able to save $10,000 per year for 40 years before retiring. If you put that into a high-yield savings account that earns 1% annual interest, you will be able to retire on $491,832. Assuming you need $30,000 per year for living expenses (increasing at 3% each year), and you’re in the 15% tax bracket, your money will last right around 14 years.

Now assume you took that $10,000 and invested it and earned a conservative 6% for 40 years. You will be able to retire on $1,670,401. Assuming the same income needs, your money now lasts forever (assuming a 4% rate of withdrawal in retirement); that is to say that you are withdrawing less than you earn in interest.

This difference, the difference between saving enough and having enough, is the key to a happy retirement – and investing has never been more accessible than it is today. It’s easier than ever before to get help with investing, without paying an arm and a leg. FutureAdvisor is a great example. They can help you maximize your retirement savings, so that when you are able to retire, you will have enough.

Premium Investing for Everyone

Historically it has been difficult for the average person to get help with their investments. Many advisors will only accept clients with high net worth (accounts valued at $500k or more). Worse yet, most advisors charge anywhere from 1-2% – eating into retirement savings at an alarming rate.

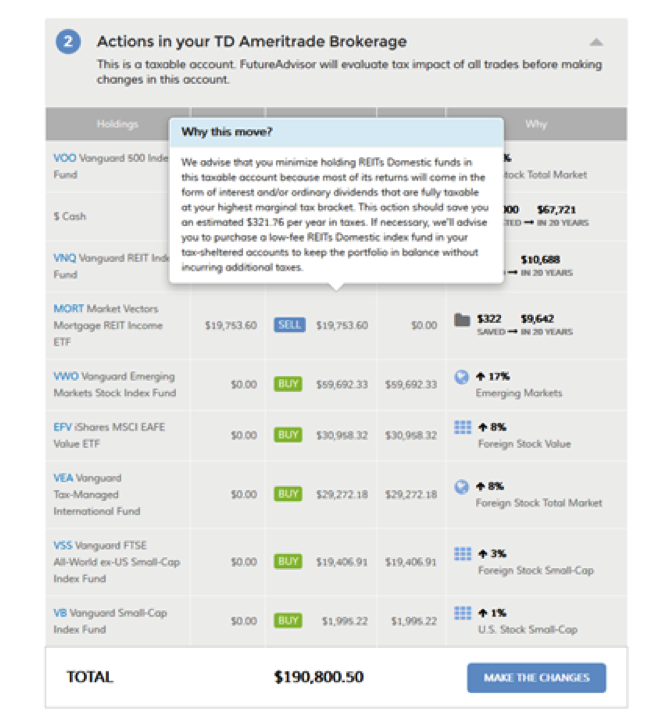

FutureAdvisor has stood out, not only by offering top notch financial advice but by being accessible to everyone at remarkably low costs. In fact, the advice they offer is entirely free. Once you link your accounts, they outline exactly how to improve your portfolio, whether it’s minimizing risk or decreasing fees.

If you don’t want to worry about managing your portfolio, that’s ok too. FutureAdvisor offers their management service for just .5% (that’s one half of one percent); lower than most people will find from any financial advisor. Best of all, your money never leaves your accounts; they aren’t pushing a proprietary fund or requiring you to hand over your money; they are transparently giving you the advice you need in the accounts you own.

This article was sponsored by FutureAdvisor. The views expressed represent the opinion of the author and are not intended to reflect those of FutureAdvisor or serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities.