By William J. Adams, Chief Investment Officer, MFS Global Fixed Income

When I think about active and passive investment strategies today, I’m reminded of that story. I believe passive performs a critical service for active managers—it gives us a laser-like focus on the most important aspect of our job, which is to generate benchmark-beating returns, or alpha. As active managers, we should appreciate passive strategies because they draw our attention to the things that we can do well for our clients.

In the current environment, active managers have tremendous opportunities to help investors. Given the challenges presented by historically low interest rates and by lower expected future returns, we believe generating alpha while managing risk is critically important for advisors and their clients. Passive strategies can’t do the things that active managers seek to do – but they can help us focus on what’s important, much as steel importers did for domestic producers a generation ago.

Passive doesn’t mean “less risky”

Passive fixed income strategies have some interesting attributes, which is why asset flows into them have been strong. Passive can offer quick and easy access to markets, while also providing liquidity and low management fees. This doesn’t mean passive investing is “less risky” than active, however. When I think about the risks inherent in passive fixed income, a few characteristics have been evident with their increasing popularity since the global financial crisis.

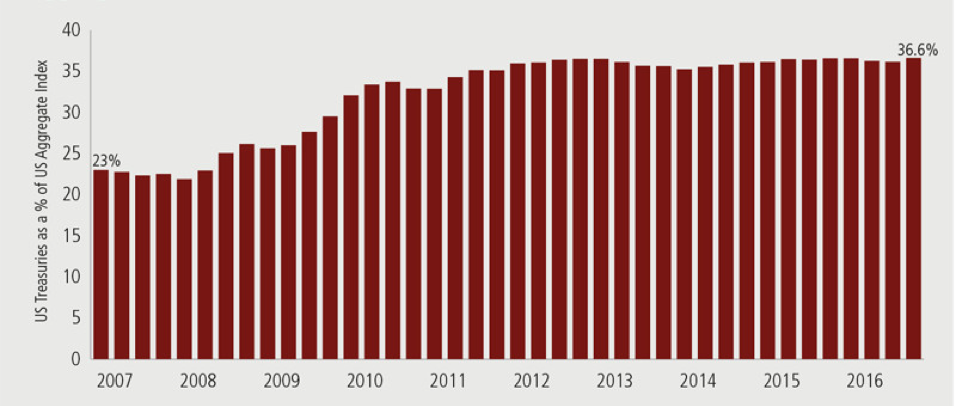

The first is the changing composition of the largest broad market fixed income benchmarks, such as the Bloomberg Barclays US Aggregate Bond Index. US Treasury bonds have become a much larger part of the Aggregate universe over the last decade, as shown in Exhibit 1. US Treasuries are the highest quality securities in the index, but they aren’t without risk. Prices of US government bonds are completely correlated with interest rates. When interest rates rise, US government bond prices fall. Since bond prices move in the opposite direction of yields, investors are more exposed to the potential of declining asset values with US Treasuries, than other investments.

Exhibit 1: US Treasuries have become a larger component of the US Aggregate Index

Source: Barclays POINT, May 2017.

For passive fixed income investors tracking the US Aggregate universe, the growing share of US Treasuries means that investors are less diversified, overall. They are also more exposed to higher amounts of lower-yielding investments — while at the same time taking on greater levels of interest rate risk.

Exhibits 2 and 3 illustrate the interest rate risk investors are taking in a passive approach. Duration, or interest rate risk, has risen for the US Aggregate Index over the last several years as yields have fallen, as shown in Exhibit 2. In fact, interest rate exposure of the US Aggregate index as measured by duration is at the highest point in the history of that index.

We can see how this affects the risk/return relationship for the US Aggregate universe in Exhibit 3. The yield-per-unit of interest rate risk has fallen, which means investors are getting less yield for the additional risk they have been taking —there is more downside than upside potential. Quite simply, investors have been taking on more risk and getting less in return. It is notable too that passive investors have been taking on more interest rate risk in this environment than they were during the global financial crisis in 2008.

Exhibit 2: Yields have dropped as interest rate risk has risen

Source: Barclays POINT, as of May 2017. Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value.

Exhibit 3: Investors have been getting less in return for the amount of risk they are taking

Source: Barclays POINT, as of May 2017.

Market cap weighting in fixed income means exposure to the most indebted issuers

The second risk I think about within passive fixed income is index replication and the common practice of market-capitalization weighting of fixed income benchmarks. In fixed income investing, market-capitalization weighted benchmarks have different construction implications than equity benchmarks. In a market-cap weighted equity strategy, companies are weighted by size—the largest companies have the biggest presence in an index, and are often characterized by the best performing securities. By contrast, the size and characteristics of bond indices are driven by how much debt a company or other bond issuer has along with the size of the individual security issued.

Consequently, investors seeking to replicate an index via a passive approach may be investing heavily in bonds issued by the most indebted companies or countries in the marketplace. In a passive strategy that replicates investment grade or high-yield corporate bonds this means investors have the most exposure to companies with the highest levels of debt. This is a potentially dangerous scenario for long-term credit investors, and a risk that passive investors may not be aware of.

Broadening the opportunity set through active management

Active managers seek to mitigate credit risk, interest rate risk and debt concentration in ways that passive strategies cannot. Active managers seek to broaden the opportunity set and allocate across sectors to find better credits — while also avoiding the poor credits. Of course, active management can be risky too. It is up to a manager to make decisions about creditworthiness, where we are in a business cycle, in addition to inflation implications, future growth prospects and the direction of interest rates, among others. At MFS®, we believe that skilled active investment management within fixed income is a powerful way to generate alpha and help protect capital for our clients on a long-term basis. We are proponents of a benchmark-aware approach to fixed income investing that provides important risk management discipline while seeking to address some of the issues associated with passively tracking an index.

More fixed income insights from MFS experts at MFS.com/FixedIncome