Betterment Review: A Better Investment Method

For many young investors, the world of finances is hard to navigate. There are so many options, so many choices, fees, dividends, taxes, rates of return… the result is that a lot of people don’t bother to invest at all.

Interest rates have been low for quite a few years. That means sticking your money in a savings account is great for short term holding, but you lose buying power (due to inflation) if it is left there for too many years. Betterment lets you invest, maintaining asset allocation, without the cost of a financial advisor and without the guesswork.

Within this Betterment review you will learn exactly how Betterment works and how it can provide you with the tools to become a better investor.

How Betterment Works

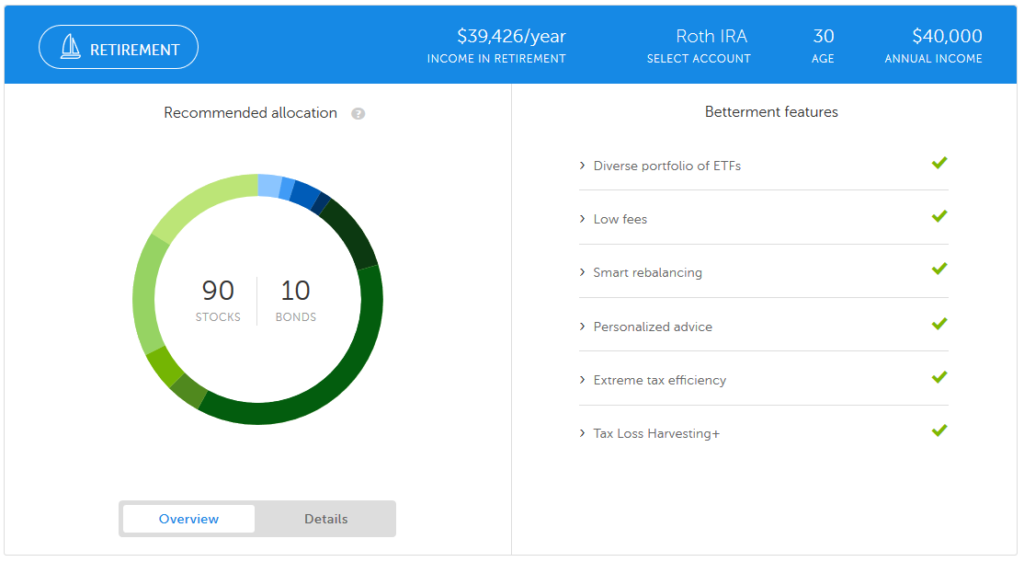

After you have created your account, you determine your asset allocation. There are two ways to do so. The easiest is to simply plug in your age and your income. Betterment determines how much you have to save and where to save it. Alternatively, you can override their asset allocation option if you want a more aggressive, or less aggressive, portfolio.

Every year, if your portfolio is out-of-balance by 5% or more, it will automatically re-allocate to bring it back into alignment. No worries on your part, no guessing, just automatic rebalancing. This will help to increase your Betterment returns.

The Selling Point: Low Fees

If you hire a financial advisor, you can expect to pay roughly 1% in annual advisory fees. Betterment offers a better solution.

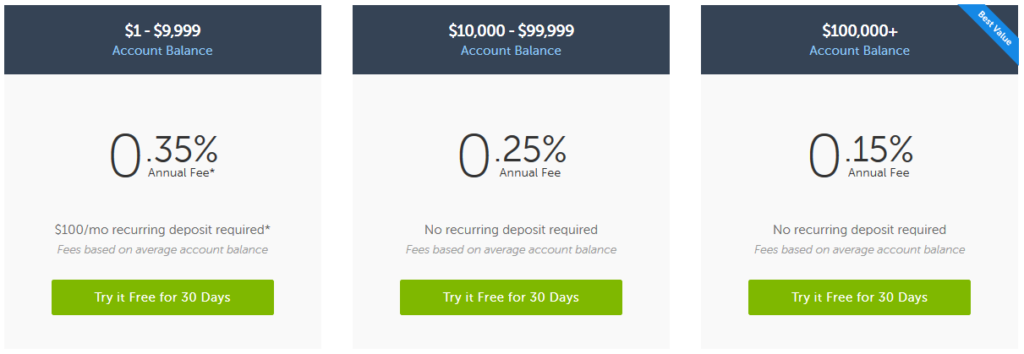

If your account has under $10,000, the fee is .35%. If you don’t sign up for at least $100 in direct deposits each month, then that fee increases by $3. With an account balance between $10,000 and $100,000 the fee is .25%, no direct deposit required; over $100,000 and the fee is just .15%.

Forcing You to Save

Speaking of that direct deposit, there is actually a pretty unique method of investing offered through this service. SmartDeposit allows you to set a certain amount in your bank account, and if your account exceed that amount, then the over abundance is automatically deposited into your Betterment account.

It’s like this. Suppose your monthly living expenses are $2,000. You like to keep a buffer of $200 in there, so you set your SmartDeposit at $2,200. Your paycheck goes in, and your account is at $2,500, so Betterment moves $300 into your investment account. It’s a pretty slick way to “force” you to save money.

Qualified and Non-Qualified

Most young people will be best served with an account that is qualified. That is, a Betterment IRA or Betterment Roth IRA that has some qualified tax benefits. But no matter what your situation is Betterment can help you meet your goals.

One of the biggest advantages is their tax advantaged plans. Through tax loss harvesting, you can earn a bigger return on your investment, and minimize your taxes. The best part: it’s all done automatically. You just have to select that you want to take advantage of the best tax situations.

Well Respected Investments

Any time you read about someone, or some company, offering investments, you have to go in with a skeptical eye. There are those that will boast amazing rates of return, but when you dig deeper they have incredibly high expenses.

A Betterment fund can use a variety of ETFs from Vanguard and iShares. These ETFs, or exchange traded funds, are similar to mutual funds that track a variety of indices. They are low cost (averaging about .05% in expenses per year), and they are well respected in the investing world.

It’s Not All Roses

Betterment does offer a great service that caters to a lot of people. But there are some downsides that you should be aware of.

Apples to Oranges Advisory Fees

When learning about the fees associated with your account, you will see a box where you can type in your account value. It will pop up how much you will pay in fees with Betterment vs. those with a financial advisor. It will then extrapolate it out over many years and show that you save many thousands of dollars with Betterment.

It’s good to save money, but when you compare these fees, you’re not comparing like accounts. Betterment accounts are robo-managed. That means they’re automatically balanced and rebalanced as you age. If you’re paying 1% advisory fees, you’re not buying a robo-advisor, you’re getting an account that is personally managed by an advisor. If all you need is an account that is automatically rebalanced every year, then you likely can find an advisor that will do that for you for considerably less.

Lack of Personal Touch

When you sign up for Betterment, you get an account that is ideally balanced to meet your personal needs. But an account designed with software can only go so far. Your needs may not quite align with their pre-programmed ideals.

If you have a complex financial situation, outside investments that need blended into your new accounts, or if you already have a high net worth (especially if you’re reaching the point where estate taxes may be an issue), then you might need more individualized attention than Betterment can give.

Final Say on Betterment Investing

Betterment provides a great service that is desperately needed in today’s society. Many people don’t understand investing, don’t understand asset allocation, and don’t understand what is needed to make sure they are on track to meet their retirement goals. Betterment takes the guesswork out of it all, and provides an easy-to-use platform that tells you just what you need.

Best of all, it’s a low cost alternative to investing in the traditional manner.

But for those that need a more complicated analysis, or more personal touch than Betterment can provide, it may not be quite right for them.