Several years ago I was sitting around having a beer with a friend of mine and he started talking about travel hacking.

At first, I sat there thinking this guy was going to land himself in jail for dark web kind of stuff. Then we talked a little more and I realized he was more a genius than a criminal.

No, he wasn’t some hacker sitting behind a computer screen. Instead, he was traveling the world for nearly nothing.

Are you starting to get a little curious as to how travel hacking works?

Sit back, relax, and let me tell you exactly how you could be taking your next vacation for nearly free.

What is Traveling Hacking?

Before we start talking about different strategies you can use, let’s begin by explaining what is travel hacking and how is it done.

In 1978, the United States government deregulated the airline industry. And what happens after deregulation?

Competition happens.

In 1981 American Airlines created the first airline frequent flyer program know as AAdvantage. That was followed up in 1983 with Holiday Inn and Marriott creating the first two hotel loyalty programs.

Then in 1985, just as I was heading off to preschool, Diners Club released the very first credit card that linked consumers spending with rewards.

Since the mid-1980’s just about every travel company has launched their own loyalty program.

So how does becoming a travel hacker relate to loyalty programs?

It’s simple. Travel hacking means you operate within the established rules of each program, but in a way that you can score free or highly discounted travel. This includes free flights, hotel stays, and even experiences.

Who can actually become a travel hacker?

Even though most people might think the term travel hacking sounds risky and potentially illegal, it’s actually very much legal and easy to do for just about anyone.

Heck, my parents are both in their 70’s and even they’ve started hacking their way to free travel.

Now don’t get me wrong, this hobby can get pretty involved if you want it to. There are three different types of travel hacking. Below I am going to walk you through each of them.

1. I’m Just Looking To Get a Great Deal

The most basic type of travel hacking is when you’re looking to get the best deal possible on a trip. Unless I am staying in an Airbnb I don’t like paying to travel so I’m not going to go very deep into this.

If you’re looking to get a great deal, make Google Flights one of your first stops. Google Flights will allow you to search for flights and give you the cheapest day to fly based on the duration of your trip.

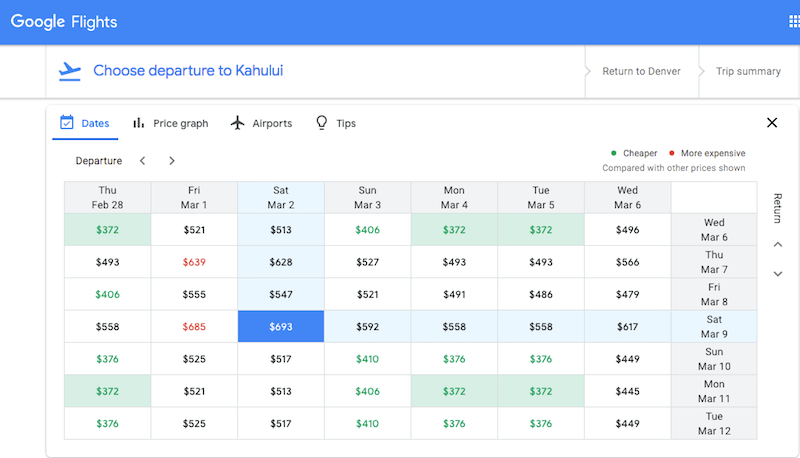

Below is a screenshot of a Google Flights result when I said I wanted to fly roundtrip from Denver, CO to Maui, HI in March 2019.

As you can see from the image, one of the cheapest ways to book this trip would be departing on March 4 and returning on March 11. The round trip flight would be $372 per person, which is nearly half what some other dates would cost.

Other tools that are great for finding the best prices on flights, hotels and even car rentals include Kayak, Skyscanner, and Momondo.

2. Earning and Burning Frequent Flyer Miles The Old School Way

The next form of travel hacking is when it starts to get fun. You begin dipping your toes into the world of points and miles.

When I was growing up, my parents and I flew TWA a lot. Then in 1995, TWA filed for bankruptcy and we switched our allegiance to American Airlines.

That’s when I signed up for my very first Frequent flyer account. Even though I was just a teenager I can remember how cool I thought it was to watch my frequent flyer balance increase with every flight I took.

I can easily be amused…can you tell?

So even back then, travel hacking was a thing, just at a much slower pace.

Even though taking flights and staying in hotels is still a way to accumulate miles and points today, it’s going to require quite a few trips before you can score a free vacation.

3. Credit Cards Will Help Make It Rain…Points

After that conversation with my friend, I became hooked. Now I’ve been hacking my way toward free travel for quite a few years. It’s allowed my family and I to see places like South Korea, Japan, Ireland, Peru, Hawaii and more.

In 2019 we already have trips planned for Hawaii, Croatia, Slovenia, Montenegro, and London…all on points.

So how are we able to collect so many points? Credit cards. My wife and I put every single purchase we make on a credit card.

Also Read: Best Travel Credit Cards for 2019

We both have several cards and we make sure we use the card that will help us maximize every purchase.

So what do I mean by this? We use the card that will help us earn the most points for every purchase.

- For gas purchases, I use my Chase Ink Plus card because it earns 2x Ultimate Reward points.

- For travel or to eat out at restaurants, I use the Chase Sapphire Reserve to receive 3x Ultimate Rewards points.

- When I travel for work I stay at Starwood properties which allows me to use my Starwood Preferred Guest credit card.

- Then for other purchases where I don’t have a card offering bonus points I use my Chase Freedom Unlimited card. It allows me to earn 1.5 Ultimate Reward points on every purchase.

So are you ready to get started? Here is what you need to do…

1. Sign Up For Every Loyalty Program Available

Loyalty programs are completely free to sign up for, which means every time you travel, make sure you sign up for applicable programs. I’m talking about everything from the airline you fly, to the hotel you stay at, and even the car rental company you use.

This means you’re never going to travel without earning some sort of reward.

Signing up is painless. All you need to do is go to the companies website and fill out your information. It will probably take you a minute or two at the maximum.

Here are some of the most popular programs:

Airlines

- Alaska Airlines Mileage Plan

- American Airlines AAdvantage

- Delta Skymiles

- Frontier Airlines Discount Den

- Hawaiian Miles

- Jetblue TrueBlue

- Singapore Airlines Krisflyer Miles

- Southwest Rapid Rewards

- United Airlines MileagePlus

Hotels

- Hilton HHonors

- World of Hyatt

- IHG Rewards Club

- Marriott Rewards

- Wyndham Rewards

Bonus: Before you book any travel, paid or award, check and see if there are any promotions. Often times hotels will offer bonus points for staying a certain number of nights. The only catch is that you’ll need to opt in to get the bonus.

If you travel frequently and use several different hotels or airlines, it can be easy to lose track of the different programs. One way to stay organized would be to keep an excel sheet with all the programs and important information.

But a better option would be to use a service called Award Wallet. You can sign up for a free account and they will email you when your award balance changes or you have points about to expire.

It’s been very helpful for me.

Be Careful…Travel Hacking Requires Discipline

As a personal finance blogger, I wouldn’t be doing my job if I didn’t make you aware of a couple things.

Make sure the signup bonus is attainable

Credit card issuers attract consumers by offering attractive signup bonuses. However, before you can get the bonus there is a spending requirement you need to reach.

Sometimes it might be $500, but cards with big bonuses could require you to spend $5,000 or more within just a few months.

Before you apply for the card, make sure you’re going to be able to comfortably meet the spending requirement. If you can’t, skip the card.

Pay your card in full each month

Credit cards come with risks. If you are not comfortable with your ability to pay off what you spend each month, stick to cash.

If you get yourself into a situation where you can’t pay your bill in full each month, the finance charges will start cutting into the value you’re receiving from the points and miles earned.

Travel Hacking Successes

“My wife and I have been able to get a few free cruises from travel hacking,” says Lance Cothern, founder of Money Manifesto. “It’s a pretty sweet deal. We’ve used credit card rewards to get free five and seven day cruises on a couple Carnival cruise ships. We used rewards or cash back to pay for everything from the cruise fare to the gas to drive to the port and the parking fees to leave our cars at the cruise terminal.”

“My husband and I each earned over 220,000 American Airlines miles a couple of years back by signing up for two cards each that offered 100,000 mile bonuses,” says Vicki Cook, co-founder of Women Who Money. “With kids in college, it was easy to meet the minimum spending and the college didn’t charge any fees for using a credit card! We also had spending to do as we remodeled our house to sell. It was great timing for us to earn almost 450,000 miles in the summer of 2016.”

“I was in Costa Rica on what was supposed to be a relaxing trip, only to find that our Airbnb wasn’t quite how it looked on the website,” says Austin Grandt, founder of Financial Toolbelt. “We made it through the first night, but by the second we were ready to go. Hotels were either insanely expensive or all booked up. Luckily, I could transfer my Chase Ultimate Reward points to Hyatt. I booked the only opening we had, canceled the Airbnb, and started driving. Little did we know our hotel, the Andaz Papagayo, can easily be upwards of $500 a night! We stayed in luxury for the rest of the trip and had an amazing time all thanks to saving up our miles.”

The Best Credit Cards For Travel Hacking

So now that you are in the loop about how travel hacking works, it’s time to learn more about the best credit cards you should be using.

Chase Sapphire Reserve

Like I mentioned earlier, I love using my Chase Sapphire Reserve card for travel expenses and when I eat out at restaurants. The reason is that the card will allow you to earn three Ultimate Reward points for every $1 I spend. Every other purchase made with the card earns one point for every $1 spent.

When you sign up for the Sapphire Reserve card you will earn 50,000 points after spending $4,000 on purchases in the first three months.

What I love most about Ultimate Rewards are the ways they can be redeemed. You can either use them to book travel on the Ultimate Rewards travel portal or you can transfer them to one of the many partners.

When you book travel, each point is worth 1.5 cents each. That means the signup bonus is worth $750.

However, you can also choose to transfer points to any of the following partners. Each of these can provide amazing value.

Airlines

- Aer Lingus

- British Airways

- Flying Blue (loyalty program of Air France & KLM)

- Iberia

- JetBlue

- Singapore Airlines

- Southwest

- United Airlines

- Virgin Atlantic

Hotels

- Hyatt

- IHG

- Marriott

- Ritz-Carlton

The biggest downside to the Chase Sapphire Reserve is its $450 annual fee. However, there are quite a few perks that easily help to offset the cost.

The biggest is the $300 travel credit each calendar year. You will receive a statement credit on your account for the first $300 you spend each year on travel. It could be airfare, hotels, rental cars, or anything else that Chase codes as a travel expense.

You will also receive a $100 statement credit every four years to cover the fee for either Global Entry or TSA Precheck. Traveling as a family of four, TSA Precheck has helped us save so much time going through security.

Another benefit that we use a lot is complementary lounge access through Priority Pass. With Priority Pass we can enter over 1,000 different lounges in 500 cities. These are great when passing time during a long layover.

Chase Freedom Unlimited

My favorite everyday spending card is the Chase Freedom Unlimited card. This is the perfect card for anyone looking for a simple way to start earning rewards.

You will earn a $150 bonus after spending $500 on purchases within the first three months. Then each time you use the card you will earn 1.5 percent back on $1 spent. However, if you have a different Chase card that earns Ultimate Rewards, you can convert your cash back into Ultimate Reward points.

The best part about the Chase Freedom Unlimited card is that it has no annual fee and it offers zero percent APR on both purchases and balance transfers for 15 months.

Barclaycard Arrival Plus

Another card that’s a favorite for many, but isn’t in my wallet yet, is the Barclaycard Arrival Plus. Right now it’s offering a limit time 70,000 mile signup bonus after you spend $5,000 on purchases within 90 days.

You will earn 2x points on every purchase you make with the Barclaycard Arrival Plus card. When it comes time to redeem the miles you’ve earned, you can do so for one cent each on any travel expense.

Each time a travel expense is posted to your account, you can choose to use miles to cover the cost in the form of a statement credit.

One nice perk of this card is that you’ll receive five percent of the miles you redeem back into your account. That means if you spend 50,000 miles on a flight, it will actually only end up costing 45,000.

The Barclaycard Arrival Plus does have an $89 annual fee, but it’s waived the first year.

The Biggest Travel Hacking Opportunity

Depending on who you ask, many people are going to give you a different answer for what the best travel hack really is. Some people might tell you it’s the ability to score a first-class flight for around 150,000 to 200,000 miles. Considering that flight probably cost over $10,000, that’s a great value for the miles.

But for me, the great travel hack is earning the Southwest Airlines companion pass.

Southwest Airlines is my favorite airlines to fly for domestic flights. They have friendly customer service agents, they give you two free checked bags, and they have low fares.

Having the ability to earn the companion pass, which is essentially a buy one get one on tickets, puts them over the top.

To earn the Southwest Airlines companion pass you need to earn 110,000 Southwest points within a calendar year. Well, guess what. It can be done through credit cards.

Because the signup bonuses earn on Southwest credit cards count toward the companion pass, you can get close with just a couple of cards.

Making the Southwest Companion Pass Even More Valuable

When you earn the Southwest Companion Pass it’s good for the remainder of the calendar year and the entire following year. To fully maximize the benefits, the key is to complete the minimum spend on the credit cards and earn the Companion Pass just after January 1.

So for example, let’s assume you reach 110,000 Southwest points on January 20, 2019. That means you would receive the companion pass for the rest of 2019 and all of 2020. That is nearly two full years.

Pretty awesome huh?

Are You Ready to Become a Travel Hacker?

This was a ton of information, but hopefully, you have a better understanding of what travel hacking is and how it works.

No, it’s not going to land you in jail, but it is going to help you travel the world for free.

Just keep one thing in mind before you get started. It’s absolutely critical that you can your credit card in full each month. Finance charges will completely offset the rewards you earn.

Good luck and happy travels!