It’s no secret that millions of people struggle each day with the burden of debt. It’s a feeling that can completely overwhelm your life. If you are fighting debt and want a simple way to get back on track then ReadyForZero is exactly what you need.

ReadyForZero is a completely free (they do have paid versions) online tool that is designed to help guide you through your debt payoff process. Think of them as a coach that is with you every step of the way.

How ReadyForZero Works

It is extremely simple to get started with ReadyForZero. Even someone who isn’t tech savvy should have no problems. Once you have set up your username and password you need to start linking all of your debt accounts. This could be your credit cards, student loans, car loans, mortgage, etc. After that you need to enter your bank account information for the purpose of making debt payments.

One thing I really like is that ReadyForZero does not personally store any of your financial information. They pull all of your data, but your personal information is never stored They are completely PCI-DSS compliant which means they are as secure as a bank.

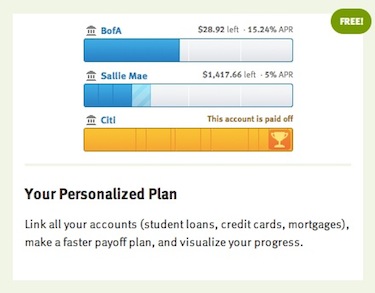

Once you have linked all of your debt accounts to your ReadyForZero profile you will be able to see your balances, interest rates and also the minimum amount due for each. By being able to see your accounts you will be able to visualize what has been paid off and the work you have left to do.

Creating a Plan That Works for You

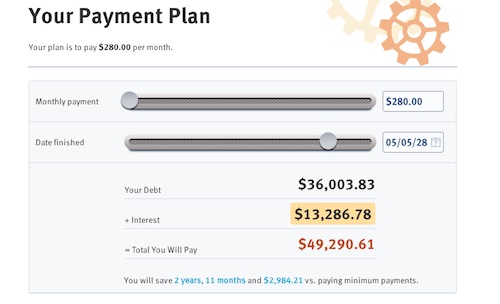

One of my favorite features of ReadyForZero is that they allow you to pick a payment plan that works for you. They will show you the total amount that you owe and then will show you the amount of interest you would be paying if you only paid the minimum amount each month. You can then adjust the plan to whatever you and your family feel comfortable with. Maybe you decide that you would like to pay off an extra $100 each month. You will then be able to see the difference that extra $100 will make in terms of total interest paid.

Once you get started on your payment plan you will be able to follow a progress graph that will track how far you have come in terms of debt repayment. It will also show you when you can expect to make your last payment if you stay on track.

I am a very visual person so I love graphs. It could be in my investing account so that I can see my portfolio value going up or it could be in a ReadyForZero account watching someones total debt go down. Graphs help people gain confidence in what they are doing.

Your Payoff Plan Can Be Changed

Let’s say that you ended up setting your plan up so you pay an additional $100 each month towards debt. Things in life can change and it can affect how much extra disposable income we have each month. You might get laid off from your job. You might have a baby and one parent decides to stay home with him or her. Just because life changes doesn’t mean you have to completely get off track. ReadyForZero allows you to modify your monthly payment amounts so that you still feel comfortable and your progress is forward not back.

They Follow the Debt Avalanche Method

Personally when I talk to people about their debt I strongly encourage the debt avalanche method. This is where you try and knock out debt with the highest interest rate first. This is how ReadyForZero also approaches it. Once you have paid your minimum balances anything you put over and above will automatically go towards the debt with the highest interest rate.

They have a Mobile App

Most people live very busy lives, which means that having things available at your fingertips is pretty important. ReadyForZero has a mobile app which makes it so you can access your account from anywhere. This is perfect if you forget that you have a payment due at the end of the week and you don’t want to risk forgetting. You can log into your ReadyForZero account and set up your payment immediately.

ReadyForZero PLUS and PLUS Credit Features

Earlier I mentioned that ReadyForZero also has paid versions. This is affordable at just $10 per month for PLUS or $15 per month for PLUS Credit. You will be able to completely automate your plan. With ReadyForZero PLUS you will be able to set up your automatic payment options whether it’s weekly, monthly or bi-weekly.

I love that they off bi-weekly payments because they can help drastically cut down on the total interest you pay over the life of a loan. Take a look at this bi-weekly payment calculator to see how it could help you.

With ReadyForZero PLUS Credit you will also get your VantageScore 3 credit score which is provided by Experian. Each month ReadyForZero will update your credit score and show you your progress.

If you sign up for ReadyForZero PLUS or PLUS Credit before February 15 you can save 10% off the price when you use coupon code plusonesmartdollar.

Final Thoughts

No matter if you are tens of thousands of dollar in debt from credit cards or you simply have a mortgage that you are trying to pay off ReadyForZero is a great way to help you through the process and keep you on track.

Thanks for explaining about ready for zero as I’ve hear about but i didn’t know much about it.