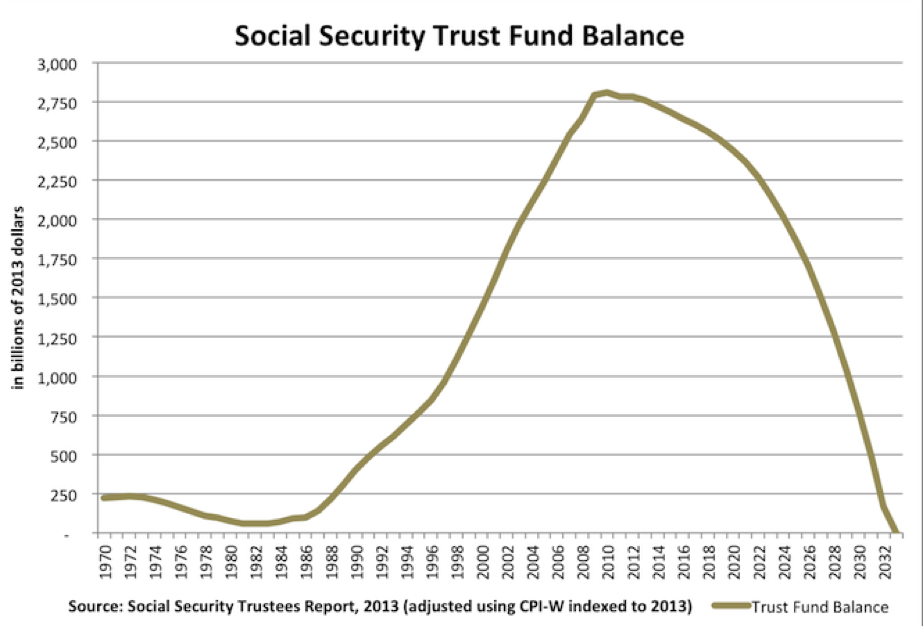

The dreaded day when the social security “trust fund” will be depleted is getting closer and closer. Most people know that not all is well with social security, but the don’t know the real numbers.

Fact 1: Most forecasters say that by 2033 the social security fund will run out.

Fact 2: Once the fund runs dry, in theory Social Security can only pay to recipients what is being paid in by workers.

Fact 3: In 2033, the forecast is that there will be available only about 75% of what has been promised.

This is frightening news for anybody who plans on having their entire promised social security amount. But do we pretend nothing will change? I believe it’s prudent for those in the upper half of assets and income in this country to prepare for social security cuts. Why do I say the “upper half”? Because most likely social security will be means-tested by assets, income, or both.

What Does The Mean For Retirement Portfolios?

As a case study, let’s see what happens if social security benefits are reduced by 25% for a couple. I looked at a couple’s plan in the WealthTrace financial planner. You can run your own scenarios for free in our planner as well.

This couple I looked at is 50 years old and has $500,000 saved. Their portfolio is split 75% in value stocks and 25% in bonds. Half their money is in an IRA and half is in a taxable account. They plan on spending about $60,000 per year in retirement.

Also Read: Inflation – Effects on Retirement Income and Ways to Tackle It

If nothing happens with social security, this couple is just fine in retirement. I found that their probability of never running out of money, using Monte Carlo analysis, is 85%. But if their social security benefits are reduced by 25%, their odds of plan success drop to 50%!

I ran some more scenarios where social security is reduced. Here is what I found:

|

Reduction In Social Security |

Probability Of Never Running Out Of Money |

|

0% |

85% |

|

10% |

70% |

|

15% |

64% |

|

20% |

59% |

| 25% |

55% |

How To Replace That Lost Income

If social security payments are actually reduced, this will ruin many people’s retirement plans. Most people are not prepared for such an outcome.

So how can we replace any lost social security income? We cannot do it with bonds, since interest rates are historically low. In my opinion, we need to use solid dividend-growth stocks who have a long history of never cutting their dividends. These include such great companies as Johnson & Johnson (JNJ), Altria (MO), Exxon (XOM), and Procter & Gamble (PG). These companies have a long history of growing their dividends over time.

If you are not interested in putting together your own portfolio of solid dividend-growth stocks, Vanguard has a great ETF that has many of the dividend payers I have recommended before. The ETF is the Dividend Appreciation Fund (VIG).

Also Read: Top 10 Retirement Planning Mistakes to Avoid

Beware Of Snake Oil Salesmen

There will be plenty of charlatans attempted to sell us all on investments such as annuities that they claim will save them. Don’t believe it. Not all annuities are bad, but many of them have hidden fees, transfer penalties, and other charges that bring their rates of return down to a much lower number than advertised.

Don’t Bury Your Head In The Sand

It is prudent to begin preparing today for potential lower social security payouts when you retire. We all need to generate enough income in retirement so that we do not outlive our money. Until interest rates rise substantially, dividend-growth stocks are your best bet, but just make sure you do your research and find great companies that have a long history of dividend growth with few to no cuts in their dividends. These companies are the ones who will continue to pay out rising dividends for the rest of your life, so much so that the actual price of the stock eventually doesn’t even matter because you can live off the dividend income.