Investment is handled completely the wrong way in the finance industry. Think about it for a second: you pay management fees to a financial advisor to provide you with expert advice, and they get paid whether they’ve helped you to make a profit or a loss. When it’s their advice that’s led to you losing money, should you really be rewarding them?

Let’s take a closer look. Financial advisors charge a percentage of the money you have whatever their result; and in brokerage and banking, commissions are made on a per trade basis. This means that the investor is given advice in the form of trade ideas or internal research, and while he or she might not be charged directly for this knowledge, there will be a charge every time the investor enters or closes a trade. This charge can take the form of a direct commission in the spread of the price at which you make the trade (with this spread being the brokerage fee), or through an overnight interest rate charged in case you hold leveraged positions. Again, you are charged even if the result of the knowledge you’re given is a loss.

It’s becoming more and more apparent that this out-dated, historic model no longer meets the needs of the modern investor. If we don’t make a return, we shouldn’t lose even more money in additional fees – that’s just condoning poor service. And if we don’t do that in other service industries, why should we in finance?

It’s time to change the fee structures within the investment industry – and by that, I don’t mean to spell the end of the financial advisor. I just mean there are ways we can work together – investors and advisors – to reform it in a way that will realign the interests of everyone involved in the investment process.

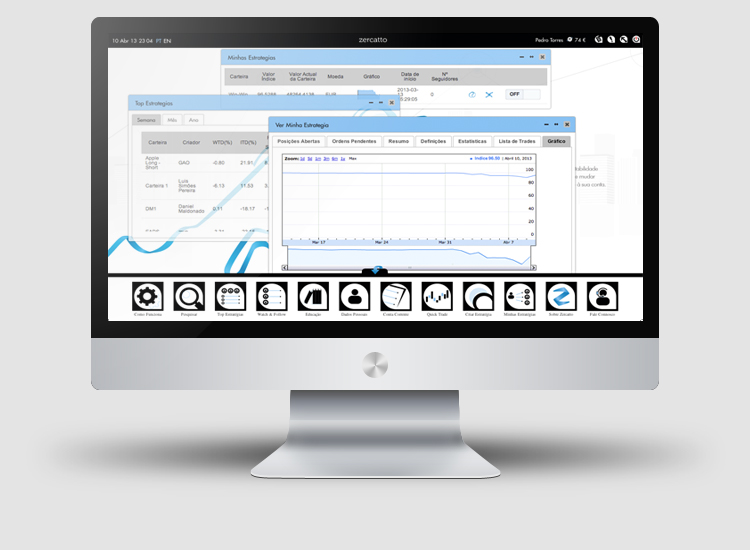

That’s why I’ve spent the last few years creating an alternative model: Zercatto operates on a “No win, no fee” basis, bringing together a community of investors and expert financial advisors. The investor pays a fixed subscription fee to follow an expert’s investment strategy in real time, but only pays when the strategy they are following is profitable, not every time the expert makes a trade.

This shift makes complete sense: investors shouldn’t bear the cost when the people they hire underperform. With the Zercatto model, investors know exactly how much they’ve committed to pay each week and experts are incentivised to promote their clients’ interests and perform.

Alternative fee models like this have proven viable in other industries, so finance is poised for reform. Think about how Google makes money from online advertising. Its pay-per-click structure (PPC) means that advertisers only pay when potential customers click on their ads, so the pressure is on Google to make sure the ad gets in front of the people who are most likely to click through to the promoted website. If Google doesn’t perform, it doesn’t get paid. Why should the finance industry expect any different?

With performance at the center of fee models, all stakeholders in an investment have a fairer share of profit and loss. Experts should be rewarded financially for making wise decisions, and investors should be confident that the person they entrust with their money is looking out for their best interests at all times. Investors should feel empowered, not trapped or tricked by the financial establishment.

The current fee model in finance is unsustainable; today’s investors should and do expect more. A fundamental realignment of the investor-advisor relationship is the only way to restore trust in the investment industry and create a mutually-beneficial working partnership.

This article was written by Gaspar d’Orey, CEO and co-founder of Zercatto.