Most of us vaguely know the correlation between bonds and interest rates. But some of it is still a bit unclear, and many people do not know what to do when interest rates start to rise. The concept is actually pretty easy if we simplify matters a little. But first, we need to see what to expect as far as interest rates go.

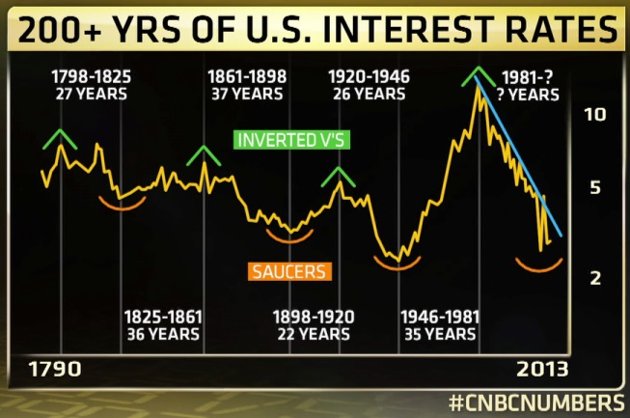

Take a look at this graph above showing the bond interest rates. As you can see, bond rates are at lows that have not been seen since the 1940’s. In fact, between 1946 and 1981, there were 35 years of increasing bond rates. But from 1981 until now, those rates have been dropping. What this means is that bonds have done (relatively) well for the last 32 years regardless of the economy. This is because as interest rates fall, bond prices increase. But now that we are at the bottom of the rates, the only place they have to go is back up. And that will cause bond prices to drop.

The reason behind the fluctuation is rather simple. Let’s say you bought a bond at par value for $1,000. It had an annual yield (interest rate) of 5%. Each year that bond would pay you $50. If interest rates increased to 6%, a bond with a par value of $1,000 would pay $60 per year. Nobody will want to buy your bond for $1,000 when they can spend the same amount and get a better return. So in order to sell your bond, the price must be adjusted downward (the amount would be determined on how many years it still has until it matures). Now if you own the bond, you can just hold it to maturity when you will get your $1,000 back (plus the last $50 payment), but if you are invested in bond funds (like most people are) there are more issues.

Since bond funds hold multiple individual issue bonds, and you cannot specify which they keep and which they sell, the price of the fund will drop when interest rates increase. There is really nothing that can be done with the exception of moving to a bond fund with a shorter duration.

All bonds come with a maturity date. And many of the mutual fund companies will manage several bond funds each with different durations. So for those looking to reduce their interest rate risk, a short-term bond fund will help to do so. In fact the shorter the term the better. If you have a bond fund that has underlying bonds with an average duration of just 90 days, rising interest rates will not have as much of an effect as those with a longer duration. This is because every 90 days, the bonds will mature and new ones will be purchased. So a higher interest rate will only have an effect for a maximum of 90 days. The caveat is that in order to get a fund with a 90 day maturity, you will probably have to go with a floating rate fund. These particular funds hold more risk than others due to the fact that they are often made up of lower quality bonds. So while the yields are higher, and the interest rate risk is lower, the default risk is higher.

There are some other alternatives to minimize risk in a rising interest rate environment. Sometimes that means adding equities. In fact, a portfolio that is all bonds takes on more risk than one that is 20% invested in equities. So if you are looking at adjusting your portfolio, you may be best served to move a little more money into equities, and move some of your fixed income (bonds) into shorter term funds. The process is really not that difficult, and you can do it yourself. However, if you do work with an advisor, ask them about the interest rate risk on your bond investments; they should be talking about this already and making these recommendations.

Have you experienced the effects of rising interest rates? What did you do?