By Pilar Gomez-Bravo, CFA, MFS Director of Fixed Income – Europe

A changed landscape

The fixed income investment universe has changed dramatically over the last few decades. In the 1970s, bonds were mostly issued in the United States and in the US dollar. Since then, bond markets have grown exponentially around the globe — across regions, in currency denominations and in credit quality. The market capitalization for debt markets reached over $100 trillion globally at year-end 2016 — an expansion of 3.5 times in just two decades.[1] Today, the US represents less than 40% of the global fixed income market. Many US investors continue to focus on domestic investment grade bonds, however, which are now less than half the overall market— and may be missing potential diversification benefits as a result.

Today’s opportunities: Combining bond sectors may improve diversification

The bond market offers diverse investment options spanning geographies (from developed and emerging economies), sectors (government, corporate and securitized), credit quality (from AAA to high-yield) and in a range of currencies. Individual segments of the bond market can be volatile at times, which is why a diversified fixed income approach may help improve a portfolio’s risk-adjusted returns and potentially improve income stability over time.

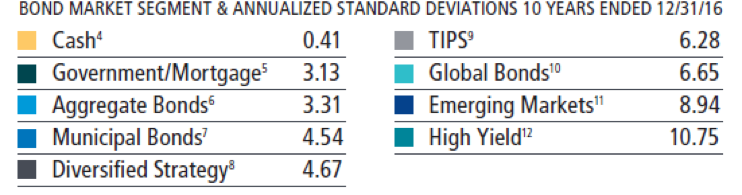

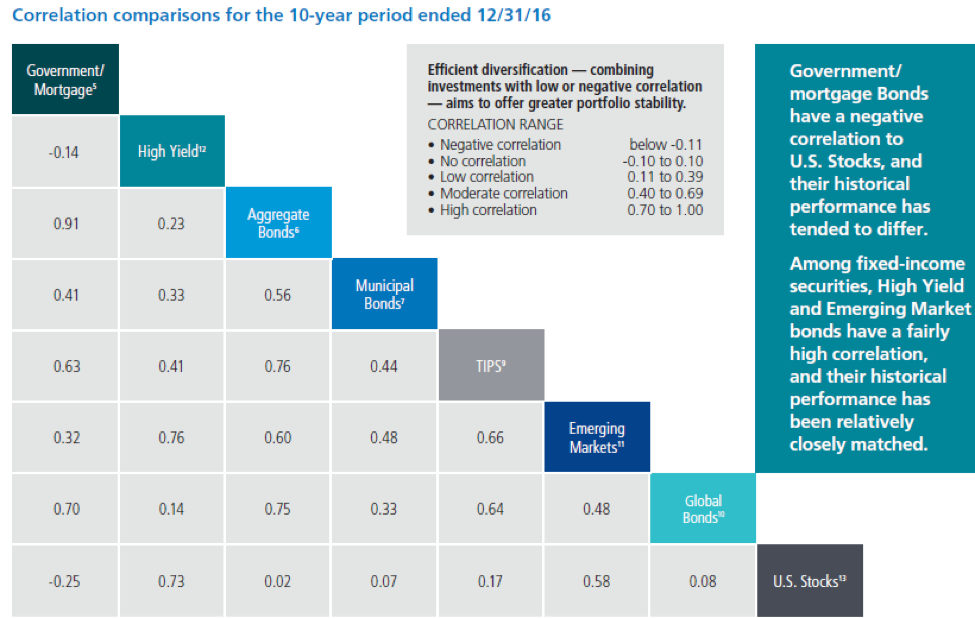

A bond strategy that included a range of fixed income exposures has historically reduced volatility and created a more consistent path for achieving long-term outcomes. In Exhibit 1, for example, a diversified strategy (see dark gray boxes), rebalanced quarterly, offered more consistent performance with less up-and-down movement than any of the single fixed income market segments during the 10-year period ended 12/31/16. However, it is important to note that diversification per se does not guarantee a profit or protect against a loss.

Exhibit 1:

Bond segments with lower correlations to each other may help diversify a portfolio

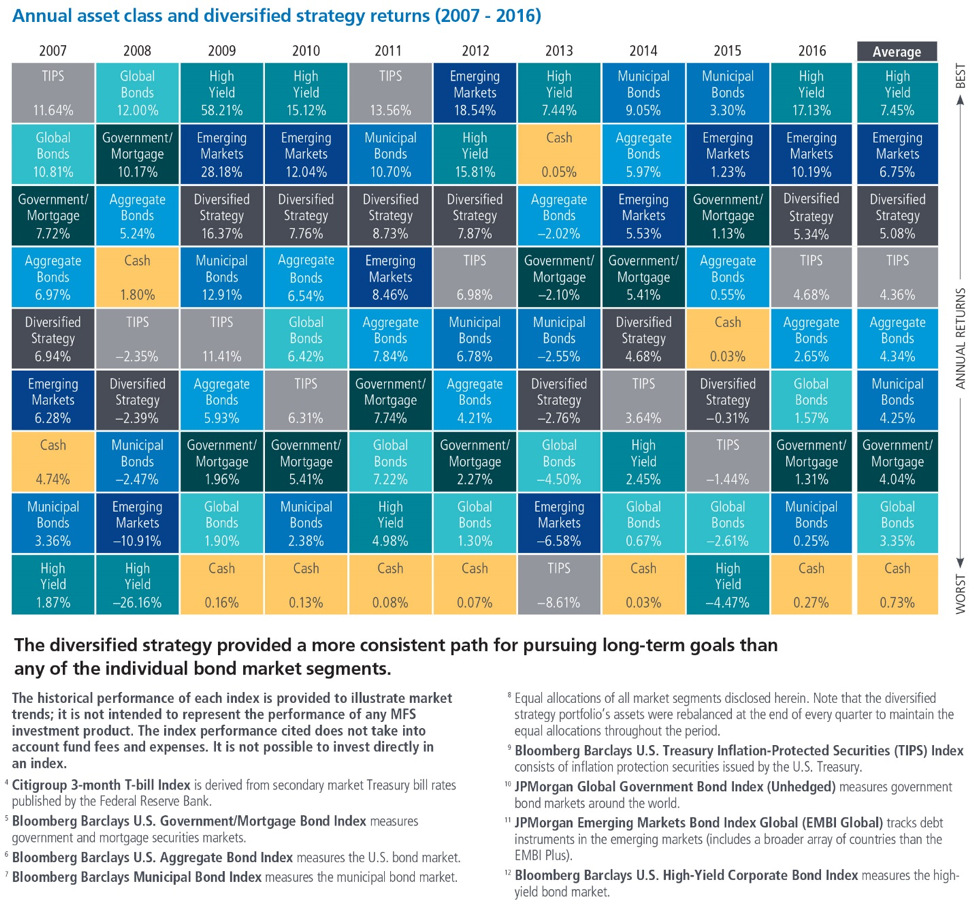

Correlation refers to how an investment or asset class performs relative to other investments during the same time period and under the same economic conditions. This concept helps investors better understand the potential benefits of diversification. A correlation value of “1” means that two investments move in tandem, whereas a correlation of “-1” means they move in opposite directions, and “0” means there is no relationship.

Historically, a high correlation between two asset classes has meant that their performance isn’t differentiated. Assets with lower correlation values have tended to perform with more differentiation during certain periods. Combining bond segments with low or negative correlations to each other may improve diversification and reduce a portfolio’s volatility over time.

Exhibit 2:

Low and negative correlations may be a good reason to include global, high-yield and nontraditional bond sectors in a well-diversified portfolio.

Fixed income has changed, but investor goals have not

While the fixed income landscape has changed over the years, investors still largely have the same goals within their bond portfolios. They seek stability, income and capital preservation. At MFS®, we believe a flexible, adaptable approach that includes a wide range of bond sectors is key to meeting those objectives while also potentially generating attractive risk-adjusted returns over full market cycles. Advisors, that’s why it’s important to work with your clients to make sure they are adequately diversified in their fixed income allocations.

More fixed income insights from MFS experts at MFS.com/FixedIncome

[1] Bank of International Settlements data, as of Dec. 31 2016.