Remember the days when schools taught kids how to balance a checkbook? Those days are long gone. I suspect there is an entire generation of kids that don’t even know what a checkbook is. The idea of keeping a paper ledger balanced is that transactions often took a long time to go through. Therefore, if you didn’t write down every single transaction, you had no reliable way of knowing exactly what your available balance was. Even the bank couldn’t help you sort it out, as they could never be sure if their records included all of your outstanding checks.

As a result, those living on the edge produced a lot of bounced checks. It is not that there wasn’t money in the bank at the time they wrote the check. But a week or two later when the check finally went through, the funds may no longer be available. In a desperate enough situation, some people might do this on purpose, kind of like a short-term loan, figuring the bank would cover it until payday. But my sense of things is that it was mostly an honest mistake: avoidable, but honest.

With today’s smartphones, we can carry the entirety of the banking experience in our shirt pocket. We can receive bank notifications, balance alerts, and budget reminders, all without having to unlock our phone. If that sounds like something out of a sci-fi space opera, here are some of the apps that will let you boldly go, well… wherever you like without worrying about your balance:

Banking Apps

Unless you do your banking at the First National Bank of Head in the Sand, your bank or credit union has an iPhone app, and likely an Android app as well. If it does not have an app, it will, at the very least, have some kind of online banking module. If the mobile sight is decent, that should be good enough. Furthermore, you will likely be able to access all the main features of your bank through an app like Mint Bills: formerly Check, formerly known as Page Once.

If you have multiple bank accounts, credit lines, etc, it can be tough to keep up with them all. Juggling a folder full of apps is not ideal. Mint Bills allows you to import all your bank and credit information in one place. You can get a quick glance at the aggregate, or dive deep into individual accounts. From this app, you can pay all your bills, even keep up with your budget. The security is the same system used by online banks. So it is no less secure than online banking. It is the app I recommend for banking and beyond.

Apps for Loans

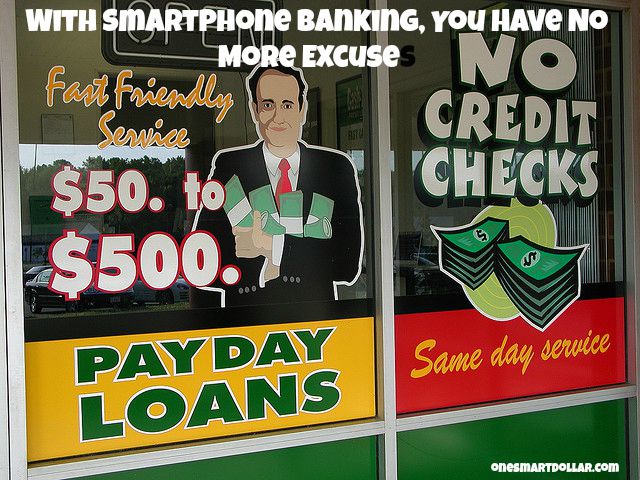

Sometimes, the unexpected happens to all of us. And it tends to happen when we least expect it. If you happen to be on vacation, and miles away from a friendly bank when the unexpected happens to you, the smartphone bank of the shirt pocket can still save the day. Institutions like Blue Trust Loans, can get as much as $1,250 in your account by the next business day. When taking out small emergency loans, it is best to pay off the balance quickly. Go directly to BlueTrustLoans.com to read up on them and make sure it’s right for your emergency needs.

Investment Apps

I’ll make this easy for you: Check out the top 20 investment apps for the iPhone and iPod touch, here. Of course, there is a Stocks app built in. But you can do a lot more than check stock prices. With the right app from companies like E-Trade, you can manage your portfolio while you are commuting on the subway.

There are still a few challenges with managing finances. But it has never been easier than it is today with a computing device you carry in your pocket. You can even make deposits by snapping a picture of both sides of a check. There really are no more excuses for not staying on top of your financial life.