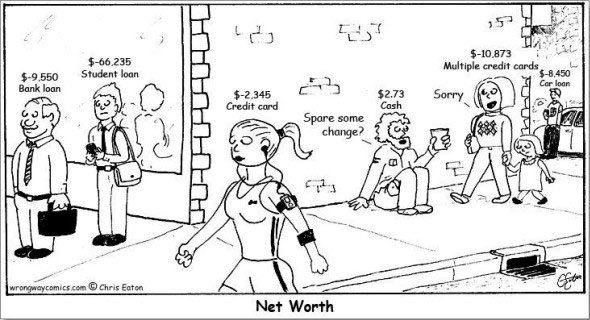

A few years ago I ran across this comic. I chuckled at the humor and shared it with my colleagues (I work in a financial services office so we see this sort of thing in real life quite often). I took some time to think about it and behind the humor are some important truths. As westerners we often have a skewed idea of “rich.” Even without diving into the philosophies of other cultures, we can find a few different financial mores in our own.

Accumulate Possessions

A good majority of people think that those who have a lot of possessions are doing pretty good for themselves. They get a mortgage for a big house, they get a couple of loans for some cars, and then they buy a boat, an RV, maybe a four wheeler or a snowmobile. In the end they have a lot of stuff, but they also have a whole lot of debt. These people drive flashy cars, wear nice clothes, and give off the appearance of being rich. But are they really rich?

Accumulate Wealth

The aspiration of many bloggers and writers is to bring their readers’ way of thinking away from the desire to accumulate stuff and start to desire to accumulate wealth. Tips and tricks on how to live the frugal life abound, and instead of debt you will have a fat 401(k), a healthy emergency fund, and plenty of money to fall back on. These people generally do not drive flashy cars or wear the latest trends. But they feel rich because they know they can handle life’s bumps because they have the money to do so. Their financial statement looks nice, but are they really rich?

Accumulate Peace

There are others who take the idea of wealth and possession accumulation with a grain of salt. They know the importance of saving, and they continue to save a little. But they also know the importance of being happy. These people often will work just enough to live comfortably, and then to spend their money on what makes them happy. Instead of spending hours and hours at the office, they delve into their hobbies and other leisure activities. They do not have flashy cars, houses, or clothes, and if you saw their 401(k) statement you would probably be shocked at how little they have saved. But these people are often the happiest and most content people out there. Instead of possessions or wealth, they have peace; but are they really rich?

Is one way of living better than the other? Is one person “richer” than the other? Personally I have worked my way down through this list. I started out wanting a lot of nice things (fortunately I never got into the debt that went with it), and that quickly gave way to wanting to be a millionaire by the time I was in my mid thirties. As I started to realize what was important to me, I decided that I didn’t need a lot of stuff, and I didn’t need a lot of money, but rather I wanted to focus on my family. I personally believe that being comfortable and happy is the best way to go. This is not to say saving money is unimportant, but I would rather enjoy life now than spend all my time and energy on making and saving money.

How about you? What makes you feel rich?

I want to use my money on the things that bring me the greatest joy and that’s living a “rich” life for me. I want my family to experience life together through travel and being able to do things we enjoy. I certainly enjoy materials things and won’t pretend that I don’t, but that is the least important part of wealth to me and the one I am willing to sacrifice for accumulation and peace of mind.

Nice post Scott! I would say that none of these are necessarily wrong taken in balance. If I had to rank them in order of importance to me I would go inversely of how you wrote them. Mostly I feel rich through my family and my faith. If I am blessed to accumulate wealth and possessions also then that is icing on the cake.

You’re right, there is no right or wrong answer. It’s whatever makes the individual person happiest.

I couldn’t agree more. A person can have all of the possessions in the world and still be an unhappy person.

This is a great post, Sean. I want to try to find that balance you talk about in your third example, but I tend to want to accumulate wealth more than I want to accumulate possessions. I think it’s great to have goals to retire early, but if you’re required to only spend $30k in retirement, then I’d rather work awhile longer because I don’t want to be stressed about money in retirement.

Great stuff. Personally, I think it’s a combination of 2 and 3. I was actually talking to my wife about this the other day, because she quoted $40,000 as some research-defined amount of income beyond which happiness stops increasing. My counter to that was that, for us, in a high cost of living area and with our current lifestyle, we could be pretty happy on a day to day basis with that income. It wouldn’t really affect our daily lives. But we could really save, we couldn’t really afford good insurance, and we would likely either face some harsh realities come retirement or if we hit a rough patch it might be tough to deal with it.

Anyways, the point here is that on a day-to-day basis, I don’t think saving and financial security has much to do with wealth. But that stuff comes into play in terms of allowing you to keep your day to day life relatively consistent in any condition. So I think a “rich” life combines fiscal responsibility with a health realization that money is only a tool and you need to find other things in life that make you truly happy.

I am in the peace category. Making more won’t make me happy so I prefer to have free time to enjoy life.

Experiences make me feel rich, not the possessions. I like the cartoon.

What makes me feel rich? Reading One Smart Dollar, of course! (alright…I had to do that….too easy). I feel rich when I can take vacations without worrying that I’m damaging my long term goals (retirement) or going into debt.

That is the million dollar answer 🙂

I’m the person who likes to accumulate wealth and I think it stems back to being safe and knowing that everything will be ok if something were to happen.