This is a sponsored post written by me on behalf of Chase for IZEA. All opinions are 100% mine.

Part of the American dream is to own a home. However, many people that would love to be homeowners have yet to make the decision to stop renting, and buy a house of their own. The reasons are many: they don’t understand mortgages, they haven’t found the right home, they are scared to take the plunge, and the list goes on. While there are some great reasons to wait, understanding your mortgage isn’t too hard to do. In fact, there is no smoke and mirrors here, it’s just math.

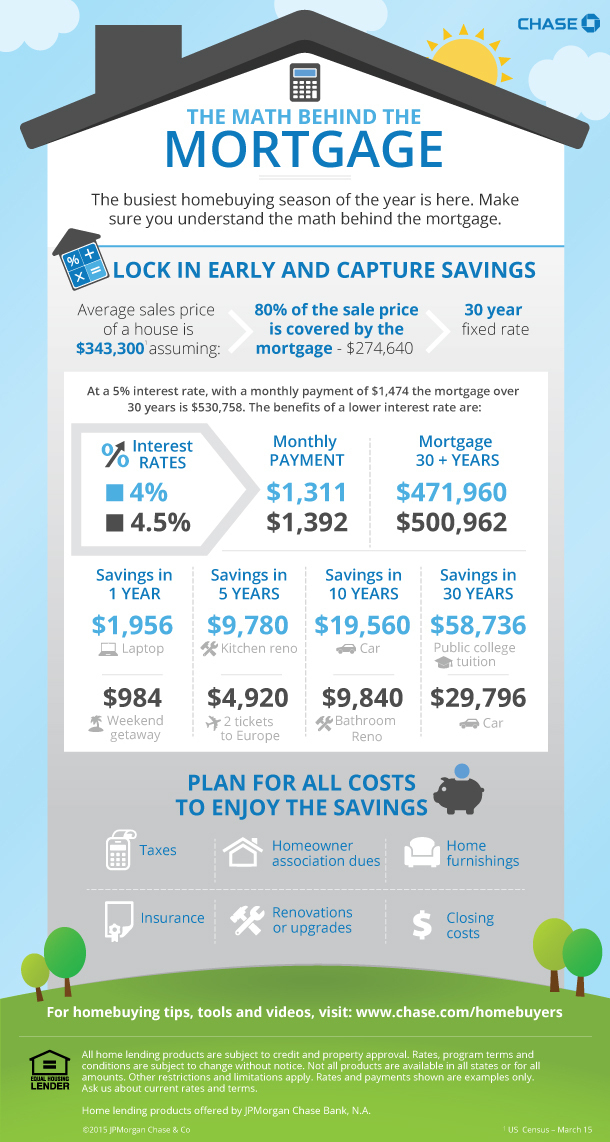

According to a recent survey by Chase, there are a lot of Americans that are ready to purchase their home. They have found the right house, and they want to get off the sidelines and buy this summer. A quick look at the math behind the mortgage may just encourage them to do so.

Where Are Mortgage Rates Going?

Throughout the first half of 2015, mortgage rates remained at near record lows. However, they are starting to creep back up, and they have already hit 4% (for a 30 year fixed rate mortgage) for the first time since November 2014. There is a lot of speculation that they will climb up even higher.

What would a Higher Mortgage Rate Cost?

Let’s suppose you find the house for you. After your down payment, you are left financing $274,640. Locking in now, with a 4% loan, will cost you $1,311 per month for 360 months. In all, you will pay $471,960 for the house; of that $197,320 is interest charges.

Now let’s suppose you wait until the end of the year to buy. By then interest rates have climbed to 5%, This loan will cost you $1,474 per month, and you will end up paying $256,118 in interest charges.

Waiting just a few months, and failing to lock in the lower interest rate ends up costing nearly $60,000 over 30 years!

There is More than Just Repaying a Mortgage

Some may look at those numbers and think that $1,474 isn’t too bad, and even though it costs more in the long run it’s better to wait and find the perfect house. But there is more to home ownership than just repaying the mortgage. Those numbers above were just principal and interest.

When you are determining the true cost of home ownership, you have to calculate in taxes, insurance, HOA dues (if applicable), closing costs, utilities, renovations, and even home furnishings. Renovations, closing costs, and furnishings can add several thousand dollars to the upfront cost of the home; the other ongoing costs can easily add another $700-$1,000 per month.

Before you settle on a home, make sure you know the total cost per month that you will end up paying.

Getting Help with the Hard Questions

Too often a potential homeowner will sit on the fence because they don’t really know where to turn for help. They don’t know any realtors (many realtors can talk about houses all day long, but know the minimal about the finances behind those houses). They don’t know any mortgage bankers, and even if they went in to talk with one, they would end up hearing a sales pitch.

Instead of wondering, those potential homebuyers can look online. If you have questions on the home buying process, the math behind the purchase, or what to expect after you are a homeowner, check out chase.com/homebuyers. They have a ton of great information that can help you make the best financial decision.

Wrapping it Up

Are you looking to become a homebuyer? Interest rates are still very low, but that won’t be the case for long. If you are on the fence, take a few minutes to do the math behind owning a home. You can then determine exactly what you can afford, and get locked into a loan before the rates jump and you end up spending thousands of extra dollars.