Hi One Smart Dollar readers! My name is Erika from the website From Shopping to Saving where I share my journey as a recovering shopaholic. I share my experiences with saving, shopping (resisting it), self-improvement, and more. Feel free to ask me questions or follow me on Twitter.

I’m sure everyone has heard of how our country is burdened with people carrying student loan debt. The amount of almost $1 trillion far surpasses any other debt out there – mortgage, credit cards, etc. A lot of people are lobbying for the government to change regulations or offer assistance that focus on those who will take out student loans or who have already taken out student loans. You may think that they are targeting all types of student loans, but the focus is always on undergraduate student loans.

If you plan to attend graduate school or an online grad school, you do not have the same options as an undergraduate student. The government believes that those that attend graduate school have the option of going and they assume that going to graduate school always correlates with a positive and large increase in salary. Because of this assumption, they do not offer many programs or benefits for those who take out graduate student loans. However, they do believe in giving everyone a chance to get their college degree, so there are many programs, grants, and benefits for undergraduate loans.

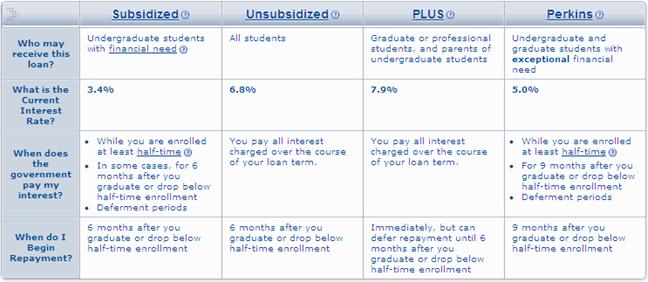

Before you decide on graduate school, you should know about loan options out there for you and how you can obtain them. Graduate students are no longer eligible to receive Direct Subsidized loans after July 1, 2012. I wouldn’t have qualified for those loans anyway since loan determination is based on your reported income from the previous year (2011 in my case, and I was working full-time). The only options I had were the Direct Unsubsidized and the Grad PLUS loan.

Because the only options that are available to “normal earners” are the loans with the highest interest rates, as well as interest being charged over the course of your loan term (meaning, while you are in school), it would be best to lessen your burden with these loans.

Let’s say you are dead set on going to graduate school. In a perfect world, you would be able to postpone going so that you could avoid taking loans out. You could get a full-time job and save up as much as possible to cover all tuition costs (tuition, books, transportation, food, living accommodations). In my case, law school is expensive and even with me saving over 80% of my salary for two years, there is just no way I am able to save $150,000 in cash plus living expenses.

As aforementioned, I don’t qualify for unsubsidized loans anymore due to new regulations, and I am also not eligible for the Perkins loan since eligibility is based off of the previous year’s tax information. Even if I went to school next year, they would base my eligibility off of 2012’s tax information, and I still wouldn’t qualify. I would have to be unemployed or living below the poverty line for a whole year before obtaining the Perkins loan.

Now I’m stuck with the options of only these two high-interest loans.

What Can I Do Now?

Use savings to reduce the amount of loans I take out: It would be best to hold off on taking out loans for as long as possible. The sooner you take out loans, the less capitalized interest you will accrue. With these two unsubsidized and PLUS loans, the interest is charged right as the loan is disbursed, instead of after graduation.

Control expenses that can be controlled: You can’t really negotiate the amount of tuition you must pay, but there are always other ways to reduce your loan amount by living cheaply and controlling living expenses. Now is not the time to live like you’re rich. Get roommates, live at home, buy used books, and stay frugal.

Pay interest on loans while in school: If you are not using loan money that you may have overestimated taking out or if you have savings, pay off interest while you are in school. This way, the overall principal of the loan will not increase as much and the interest added will not be based on a higher amount. I plan to do this.

Apply for scholarships next year: Focus on free money! I didn’t qualify for scholarship money with my application, but there’s always next school year. I will begin applying for scholarships at the end of the first semester. There are a myriad of scholarships out there.

Obtain work-study opportunities: Universities usually have work-study programs that allow you to gain experience, and get paid. The money that you earn will be automatically applied to your tuition.

Get a part-time job: Another option is to get a job outside of campus. This will also add to your work experience, giving you a resume boost (if you are doing work related to your area of study). Save the money to pay off the interest or reduce the loans you take out. I’ll be working one day a week at my current company to pay for living expenses.

Do well in school: My first priority is to do well in school. Network, work your butt off to get good grades, and it will be easier for you to obtain a well-paying job.

Are you thinking of attending graduate school? If so, have you planned for how you will pay for it?

Thanks again Sean for letting me guest post!!!

of course. Hope to have you do more in the future.

I’ve been considering grad school. Luckily in the sciences, there are usually various stipends and assistantships you can apply for to cover most if not all of the cost of attending.

I don’t plan on attending graduate school but if I were, I would try to find some really inexpensive housing in order to minimize the loans and make my life very simple.