Life after bankruptcy can be overwhelming. Not only do you have to deal with the emotional toll of bankruptcy itself, but you also have to work on the behaviors that got you there, all while trying to rebuild your credit.

Life after bankruptcy can be overwhelming. Not only do you have to deal with the emotional toll of bankruptcy itself, but you also have to work on the behaviors that got you there, all while trying to rebuild your credit.

Luckily, re-establishing your credit is a matter of diligence—paying your bills on time and showing creditors that you have learned from your experience. However, not all bills are equal when it comes to rebuilding credit. There are some bills that cannot help your credit recovery, but a delinquency on those bills can still hurt you. These are five types of bills that don’t help rebuild your credit:

Rent

While paying rent will keep a roof over your head, your on-time monthly payment to your landlord will not be reported to any credit agency. Even worse, if you fall behind on paying your rent, any of the options available to your landlord for getting your delinquent payment will seriously ding your credit report. These options include suing you in small claims court or selling your account to a collections agency.

If you’re having trouble making ends meet after bankruptcy, make sure that you prioritize your rent payment in your budget. If you were to be evicted and sued or passed to collections, it could be difficult or even impossible to find a new place to rent.

Utilities

While you have to stay on top of these to keep your basic services on at home, your payments are not reported to the credit bureaus—unless you are delinquent.

Cell Phone

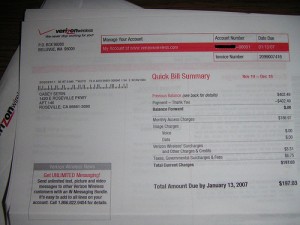

Just like utilities, nothing is reported when you pay on time, but a delinquency will show up on your credit report. It may be sacrilegious to suggest this, but you might want to try living without a cell phone while you are getting back on your feet. If money is tight, cell phones are an easy luxury to trim, particularly considering how much their bills can fluctuate from month to month if you are not careful with your usage.

Medical Bills

If you are paying off a debt to your doctor or hospital, missing payments could get your bill sent to a collections agency. Again, paying on time does not actually get reported to the credit bureaus, but failing to pay certainly can. With medical bills, however, you may be able to negotiate new terms for your bill if you are having trouble paying. These terms could include a longer payment plan or potentially lower rates if you can successfully negotiate them. It may be tough to negotiate, but it sure beats having your medical bill become delinquent.

Federal and State Tax Liens

If you owe tax to the federal or state government, the credit report will know that you have a tax lien—so you already have a negative entry on your credit report. To make matters worse, your payments to satisfy the tax lien are not reported—at least, not until you have completely paid it off.

The Bottom Line

Unfortunately, the bills that do not help you rebuild credit are also the ones you most likely need to pay in order to keep yourself afloat. If you can keep these bills paid, and add a single, manageable loan from a reputable lender, you will be on your way to proving your credit-worthiness.

Image Credit

This is good stuff! I didn’t realize that so many bills did NOT help you build credit. Thankfully student loans DO help 😉

It’s frustrating that paying bills on time doesn’t help but paying bills late can hurt!